Real Estate Investing is a great way to earn monthly income through cash flow and build your wealth. But, to purchase your next real estate investment you’ll most likely need financing. Depending on your ultimate investment goal, there are many different financing options available to you.

What is your real estate investment goal?

A: Cash Flow – ??

B: Building Net Worth –??

You need to consider your investment goals before choosing your financing. The amount of net worth or cash flow you build and receive each month can depend greatly on your loan and its terms. One of the biggest terms that can be changed depending on your investment goals is the amortization period. Amortization simply refers to the time period over which the loan will be paid off if your loan that will be “fixed” until you pay off the principal balance fully.

Real estate investment loans normally have amortization periods of 20, 25, or 30 years. This means that your loan payments will be stretched over 20, 25, or 30 years to pay off the loan balance fully. The shorter the amortization period, the higher your loan payment will be, but the faster you will pay down or pay off your loan.

What is your real estate investment goal and what financing should you choose?

A: Cash Flow – Longest loan payoff period

B: Building Net Worth – Shortest loan payoff period

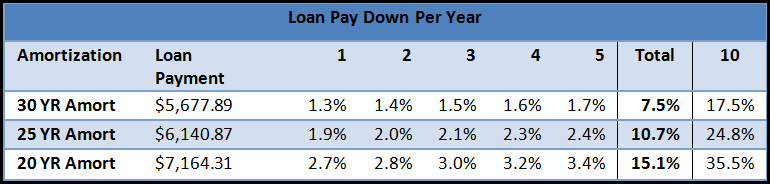

Let’s take a look at how the loan payoff period affects the Principal Pay Down and your investment. The following graphics show the same $1,000,000 loan at a 6% interest rate over 20, 25, and 30 year loan payoff periods.

As you can see, using the same loan balance and same interest rate, over 5 years you only pay off 7.5% of the loan with a 30-year amortization, where as you pay of 15.1% of the loan with the 20-year amortization. Over 10 years it gets even bigger. However, you will notice that the payment amounts are different. The difference is the amount of principal and interest you pay off each month.

The shorter the financing amortization the higher the loan payment and more principal balance you pay off each month. The longer the loan payoff period, you pay off less of the principal balance with each payment, but you get a lower loan payment. That lower loan payment allows you to take home more cash flow each month. You can see from the example that by having a 30 year amortization vs a 20 year amortization equates to a lower loan payment by $1,487 per month. That’s not a small amount.

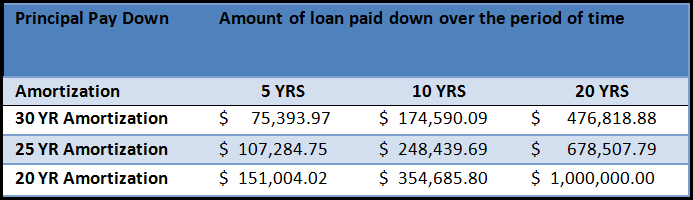

The percentage differences don’t look that big in comparison to the loan payment difference in actual dollars, but let’s look at how that loan pay down affects the real numbers:

This graphic demonstrates that the difference between a 30-year amortizing loan and a 20-year loan over just 5 years is $76,000 in loan pay down or equity. And that is on a $1,000,000 loan, which is considered small in commercial properties. If you look at it over 20 years it’s over a $500,000 difference in loan pay down or equity. Can you imagine how much would be paid off each year with a $10,000,000 loan? That’s a big chunk of change and it happens automatically when your tenants make your loan payment each month.

Whether you are investing in real estate for cash flow or to build your net worth, you can do it faster by choosing the right financing. Financing with a longer loan payoff period will help you take home more cash flow each month, while a shorter loan will build your net worth more rapidly. Aligning your investment real estate financing with your ultimate investment goal will help you get there faster.

{ 0 comments… add one now }