Investment Real Estate: A Penny Saved, A Dime or More Earned

We’ve all heard the saying “A Penny Saved, A Penny Earned”. This is very sound advice. However, in investment real estate, I like to say “A Penny saved, 10-15 pennies earned”.

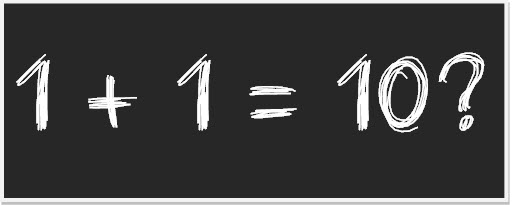

Some of you might be thinking “that doesn’t make much sense. How can 1 penny = 10-15 pennies?” When I first got started in investment real estate, I didn’t quite understand it either. But, when you understand how investment real estate is valued, you’ll realize how true and exciting this statement is.

Saving a penny in investment real estate earns you a lot more than just that penny because of how investment real estate is valued. In investment real estate such as apartments or commercial properties, the value of the property is determined by how much money the property earns after subtracting out the expenses. The amount that is left over is called the cash flow.

Investment real estate buyers are willing to pay 10 to 15 times the amount of money that the property earns on an annual basis depending on the age and quality of the property and its tenant base. Investors expect to get paid back on their investment over time. The speed at which that investment is returned to them is called the rate of return. The rate of return that an investor requires to purchase your property determines how much they are willing to pay for your property based on the cash flow (income minus expenses) it produces. Let’s take a look at how this works.

Let’s say your property produces cash flow after taking in rental income and subtracting out all expenses of $10,000 per year. If the investor will not invest in your property unless it produces a 10% return on his investment per year, then how much would he be willing to pay?

I know, you thought your days of math were over. Don’t worry, it’s not that bad. To find out the answer, all you have to do is take the income ($10,000) and divide it by the desired rate of return (10%) and you get the price that investor is willing to pay for your property. In this case, it would be $10,000/10% = $100,000. So if the investor wanted a 10% return on his investment out of the cash flow, he or she would be willing to pay $100,000.

Now, what happens if the investor’s required return decreases?

If you took a similar property, but one that is in better shape, located in a better area, and/or has better quality tenants, the investor might be willing to accept 8% rate of return per year instead of 10%. The investor is willing to do this because he believes this property is less risky. If the investor only needed an 8% annual return on his investment, how much would he be willing to pay for a property with the same cash flow?

You can calculate this value exactly the same way. You take the same $10,000 cash flow per year and divide by the investor’s desired return on his investment (8% this time) and you get $125,000 or twenty-five thousand dollars more than the previous property even if they generate the same cash flow.

So, going back to the beginning how does a penny saved or earned, really earn you a dime or more?

In the first example when the investor wanted a 10% return on his investment every dollar you raise the revenue or decrease the expenses would be equal to 10 times that amount in value. However, if the investor only requires an 8% return on his investment like in example two, that same dollar saved or earned would equate to 12.5 times that amount in value. Wow! I like where this is going. Can you imagine what would happen if the investor only desired a 5% annual return on their investment?

A penny saved is a penny earned is good advice. However, if you invest in cash-flow producing real estate, it might not cut it for you. If you’re a real estate investor, that same penny saved could save you a dime or more.