Determining Rental Rates – How and Why to Do Market Rental Surveys

Market rental survey’s are essential to your real estate investment success. Whether you are buying a new property or managing the one you have, a market rental survey is a valuable tool you cannot afford to do without. It can tell you what current rental rates are and where they are trending. It can tell you what the occupancy is in a particular area and what things are attracting the most tenants. It can also help you establish the value of a property being considered for purchase and gauge the ability to increase your return. In short, a market rental survey will help you maximize your investment property’s value.

A market rental survey is a way to determine the rental rates being achieved in a particular area by an investment property. It consists of a chart of available and comparable properties and compares the rental rates and occupancy of those properties by rental rate per unit type (1 bedroom, 2 bedroom/2 bath, etc.), square footage, available amenities, and property age and condition. It can show you what comparable rents are being achieved in an area and where your property is in relation to your competition and market.

You need to know the market rental rates in your area so that you can maximize your investment properties’ value. They can help you answer these questions: Are we charging enough, are we charging too little, are there other features we can offer that will allow us to raise rents, what are our competitors doing, what is the upside of the property, and where are rental rates heading? The answers to these questions will help you evaluate your property, options, and maximize your investment’s value. Without knowing the answers to these questions, you are just flying blind in your investment, and that is never good.

Doing a market rental survey is easy, but it can be very time-consuming. Also, you have to update it at least once a quarter to keep it up to date.

The 4 steps to doing a market rental survey:

- Create a spreadsheet or chart to collect your market rental data. You’ll want to have headers and collect information on all of the following: property name, address, phone number, unit type, size, rent per square foot, year built, and occupancy at a minimum. You can always add more information such as amenities offered, concessions given, visibility of asset, and property condition as you see fit.

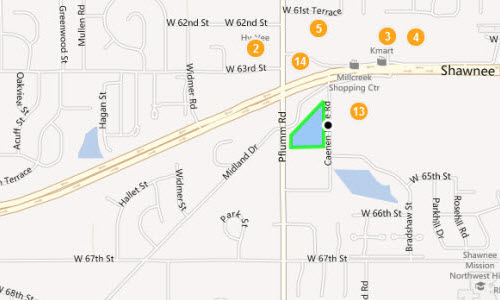

- Make a listing of competitive properties in your area. Many times you can do this by using websites such as apartments.com, For Rent, Google Maps, or by driving the area around your property and listing the properties.

- Start collecting data. Once you have the names and addresses of the properties you are going to be comparing and surveying, it’s time to start collecting data. Now is when you want to try to find all of the information for every column you listed in your spreadsheet on step number 1. A great way to find information such as amenities offered, rental rates, square footage, and concessions offered is by going to the property’s website. If they don’t have a website, you can call them if you have their number, sift through their advertisements, or even stop by their leasing office if they have one. Local realtors can also be helpful in your pursuit of this information. The key is to collect information that is as thorough as possible and to compare apples to apples (or 1 bedroom/1 bath apartments to other 1 bedroom/1 bath apartments, for example) and to keep the information up to date on a quarterly basis. Quick tip: for information such as square footage, if it’s not listed on their website or brochures, you can often find it by looking up the property’s tax records.

- Start comparing the information. Here is where you want to take the information you collected in step 3 and start breaking it down so that you can compare like properties and unit types. Make sure you are comparing 2 bedroom/1 baths to other 2 bedroom/1 baths and so on. We find that calculations such as average rental rate per square foot and unit type can be very helpful. You can also get a median figure (half above, half below). That will tell you where your rental rates compare and will point out low and high rates. With this information you can tell if your rental rates are high or low and if you have room to raise rents. By collecting this information over time you will be able to identify trends and help determine the property’s potential.

A market rental survey is essential to your real estate investment success. Whether you are buying a new property or managing the one you already have, it will help you maximize your investment’s value. They are easy to do by following these four steps, and by updating them over time you can identify key trends and help determine your investment property’s potential.